Cool Info About How To Lower Car Insurance Rates

Getting lower car insurance premiums can save you money.

How to lower car insurance rates. Insurance companies charge different rates for the same coverage. Whether it’s your car or your home, lowering your risk of having to file a claim helps keep your insurance rates down. Reviews trusted by more than 45,000,000+.

Compare car insurance rates every six months. Compare auto insurance rates across 40+ top providers. Shop around for a lower rate.

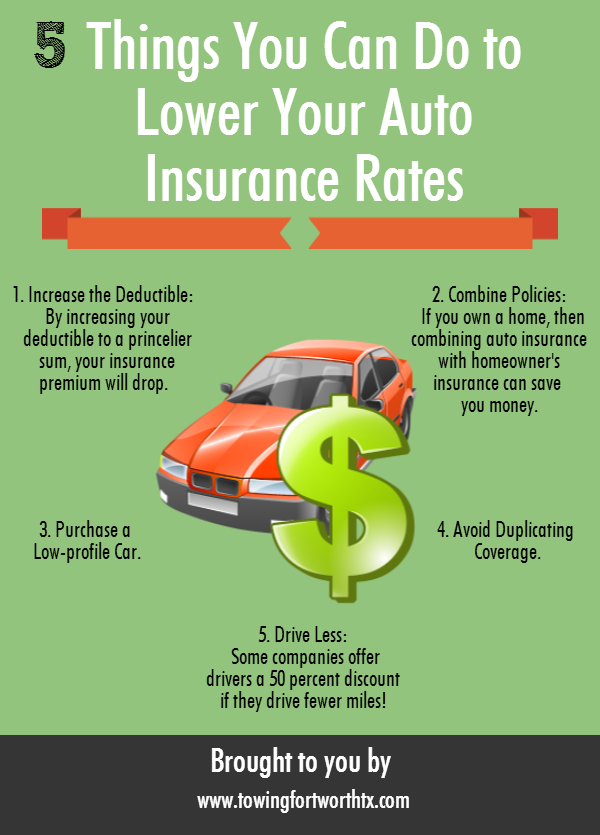

Common discounts to lower your auto insurance1, buying your policy online, enrolling in preferred payment options such as automatic payment, bundling you car insurance with your home. Raise your auto insurance deductible to reduce your rates. Don't settle on your first quote.

If you pay your car insurance policy premium up front and in full, before the policy effective date you usually get a 5 percent to 10 percent discount. Ad 2022's best car insurance. Car insurance costs over $135 a month on average, according to nerdwallet’s rates analysis.

Get a quote in about 6 minutes! Shop around for a new policy. Ask if your policy includes an accident forgiveness clause.

Try these suggestions to save hundreds of dollars a year on your insurance bill. Lowest rates across the us. The insurance information institute says raising your deductible from $200 to $500 could reduce the cost of your collision and comprehensive coverage by 15% to 30%.